Need money fast? You might be tempted to search for the Fineday Funds phone number. While the promise of immediate cash is appealing, understanding the realities of Fineday Funds and tribal lending is crucial before you borrow. This article provides a balanced overview of the advantages and disadvantages, helping you make an informed decision.

What is Fineday Funds?

Fineday Funds offers short-term loans and operates under the authority of the Menominee Indian Tribe of Wisconsin. This tribal affiliation significantly impacts its regulatory environment and lending practices. While convenient access to funds may seem appealing, understanding the implications of this arrangement is key to responsible borrowing.

How Fineday Funds Loans Work

Applying for a Fineday Funds loan typically involves a straightforward online application. However, a critical aspect often overlooked is the lack of complete transparency regarding fees and interest rates. Before proceeding, diligently investigate all costs associated with the loan.

- Application: Provide financial details and your desired loan amount.

- Review: Fineday Funds reviews the application; processing times can vary.

- Approval/Denial: If approved, review the loan offer carefully, focusing on interest rates and fees.

- Funding: Funds are typically disbursed quickly upon acceptance.

Fineday Funds: Pros and Cons

Advantages:

- Speed: Fast funding can be beneficial in emergencies.

- 24/7 Support: Access to customer service is available around the clock.

- No Prepayment Penalties: Paying off the loan early incurs no extra charges.

Disadvantages:

- High Costs: Interest rates and fees are significantly higher than traditional lenders, potentially leading to a debt trap. Are you prepared for the high cost of this convenience?

- Lack of Transparency: The details of fees and interest rates may not be fully disclosed upfront, necessitating thorough investigation.

- Regulatory Uncertainty: The legal framework governing tribal lending is complex and subject to change, creating uncertainty regarding borrower protections.

Understanding Tribal Lending: Navigating the Complexities

Tribal lending operates within a unique regulatory landscape. The Menominee Tribe's involvement in Fineday Funds means its operations are subject to the complexities of tribal sovereignty and its interaction with federal and state consumer protection laws. This grey area requires careful consideration.

Alternatives to Fineday Funds

Before seeking a high-cost short-term loan, explore these alternatives:

- Banks and Credit Unions: While application processes might be longer, these institutions generally offer lower interest rates and greater consumer protections. Is waiting a few days worth the long-term savings?

- Peer-to-Peer Lending: Platforms connecting borrowers and lenders can provide more competitive rates. Do your research before choosing one.

- Budgeting and Financial Counseling: Addressing underlying financial issues can prevent the need for high-interest loans. Consider seeking professional help before taking on debt.

Protecting Yourself: Smart Borrowing Practices

Before borrowing from any lender, especially those with high costs, take these steps:

- Compare Loan Offers: Thoroughly review all fees and compare the total cost over the loan's lifespan.

- Investigate Alternatives: Explore lower-cost options before committing to a high-interest loan.

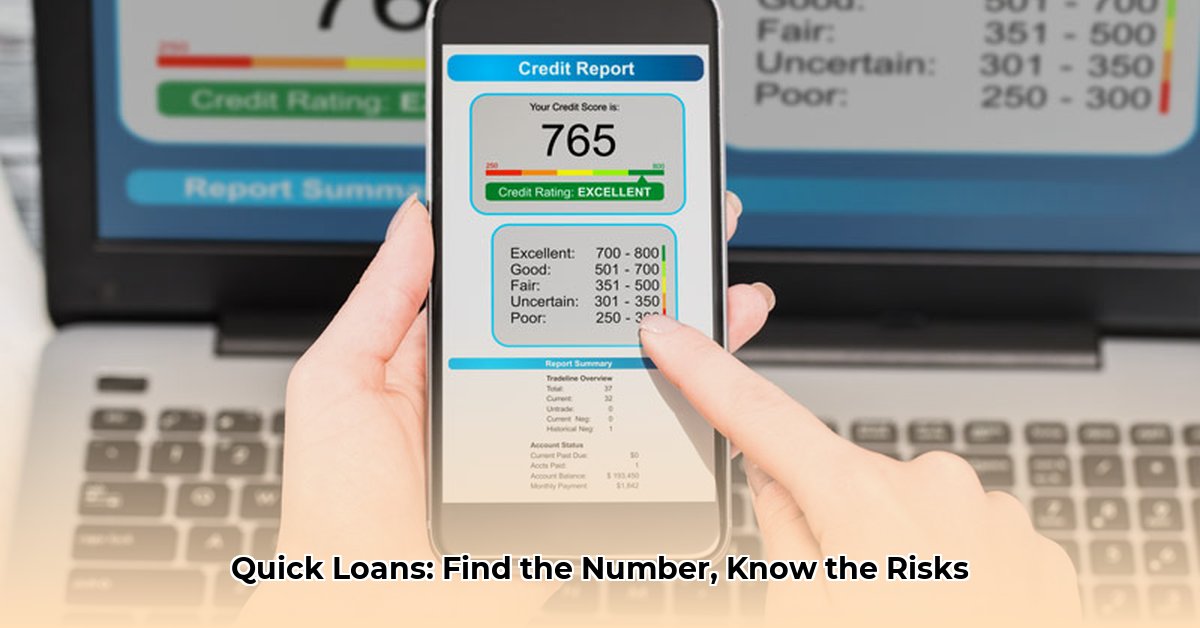

- Check Your Credit Report: Understanding your creditworthiness helps you determine your eligibility and potential interest rates.

- Read Online Reviews: Learn from other borrowers' experiences by checking online reviews.

- Understand the Risks of Tribal Lending: The lack of robust consumer protections makes tribal loans a higher-risk financial choice. Is the risk worth the reward?

Conclusion: Informed Borrowing Decisions

This article isn't an endorsement of Fineday Funds or tribal lending. Always conduct thorough research before borrowing. Consider the Fineday Funds phone number a last resort, only after exploring safer, more affordable alternatives. Prioritize responsible financial management and make informed decisions to protect your financial well-being.